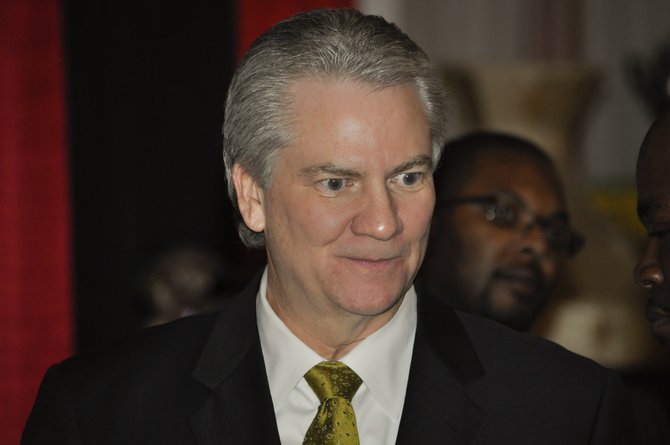

Duane O’Neill of the Greater Jackson Chamber Partnership said the citizens of Jackson voted to increase their own taxes, but business groups argue the tax would have had unintended consequences. Photo by Trip Burns.

A legislative change to Jackson's 1-percent sales-tax law would prevent a retail price increase on beer and light wine, the trade association that lobbied for the legal change said.

After years of political wrangling over the law's controversial provisions, including a 10-person oversight commission, more than 90 percent of Jackson voters agreed to charge themselves an addition 1-percent in taxes on most goods with the understanding that an estimated $15 million per year in extra revenue would help address the city's long-bemoaned infrastructure.

In March, the tax took effect. Soon afterward, the Mississippi Legislature amended the original 2009 law that made it possible for the city to hold a city referendum on the tax. Under that legislation, the sales tax would exempt food and beverages at restaurants. The Mississippi Malt Beverage Association said there were other unintended consequences as well.

"It became a 1-percent price increase (on beer and light wine) to the retailers," said Ricky Brown, president of the MMBA.

That's because, under state law, wholesalers of beer and light wine charge a 7 percent sales tax to retailers; retailers in turn apply that 7 percent tax as a state income-tax credit. Under the original sales-tax hike, wholesales would have to charge retailers 8 percent in sales taxes. But retailers would then pay the additional 1-percent to the retailer, but only receive a 7-percent tax credit.

Brown's groups approached lawmakers, and the changes were included in House Bill 787, which approved state spending on infrastructure upgrades around the state.

Still, the change worries city of Jackson officials, who have requested an opinion from Mississippi Attorney General Jim Hood's office.

As a result of the change, city budget planners feel under pressure to adjust the spending plan for the tax revenue. Ward 4 Councilman De'Keither Stamps said the original plans for the $15 million included major funding for storm water, city water, city sewage, streets and drainage. If revenue is chopped, the entire plan will have to be revamped and reprioritized, city officials say.

"Those are interconnected plans," De'Keither Stamps told the Jackson Free Press in an interview earlier this month.

Duane O'Neill, president of Greater Jackson Chamber Partnership, said the changes to the sales-tax law came a "surprise" to his organization, which represents businesses in the Jackson metro. O'Neill said he needed to investigate the assertion of the malt-beverage association about the sales tax as originally proposed leading to price increases at the retail level.

"The idea is that when the voters went to polls, it was one thing, and it comes out a different thing," O'Neill told the Jackson Free Press, adding that perhaps a study should be commissioned to consider the full impact of the law change.

But for O'Neill and other city officials such as Stamps, the citizens voted to tax themselves in January regardless of the law's ripple effects, and that vote should be honored.

"That's what everybody thought they voted on," he said of the original sales-tax proposal, "and (citizens) are the ones are that make the choices."