I promised this a while ago and immediately began to dread the hours and energy it would take to plow through this. :-)

I think I've finally done the work here, though, and can present. So, without further ado, here is a look at my update to Wyatt Emmerich's infamous "Welfare" chart.

Note: for the backstory, read my original blog entry, the New Republic piece and Wyatt's original editorial, wherein he fairly succinctly states his thesis:

"You can do as well working one week a month at minimum wage as you can working a $60,000-a-year, full-time, high-stress job. My chart tells the story. It is pretty much self-explanatory," he wrote.

Indeed.

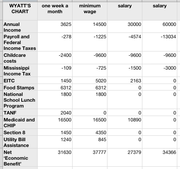

First, his chart, recreated here in my spreadsheet program from the chart that was printed by TNR. (I can't access Wyatt's original because the story link is "printer-friendly" and it's not clear whether the chart made it to the Web.)

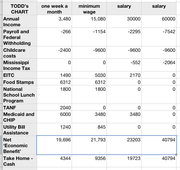

Second, here's my chart.

Here are the footnotes and discussion of the differences:

1.) ANNUAL INCOME. Just nitpicking a bit, but I calculate minimum wage working one week per month as $7.25 * 40 * 12 = $3480; full-time at minimum wage is $7.25 * 40 * 52 = $15080, unless we assume an unpaid vacation. I didn't.

2.) PAYROLL AND FEDERAL WITHHOLDING. The Federal withholding calculated for all four income levels was done by taking 9 exemptions. I got that two different ways -- using an actual w-4 form and using this website (http://www.paycheckcity.com/W4/w4instruction.asp). The 9 exemptions appear to be: 1 for yourself, 1 for your job, 1 for head of household, 2 for each dependent, 1 for childcare credits and 3 for child credits.

This was a critical mistake in Wyatt's original chart; by chosing the family that he did, he managed to maximize benefits on the social safety-net side -- after all, you can't get Medicaid as an able-bodied, working-age adult unless you've got kids and/or are pregnant; you're not eligible for TANF; you don't get school lunch subsidies or as much in food stamps.

However, that same family also maximizes the deductions you get to take, significantly increasing take-home pay for our families with higher incomes, something he didn't take into account in his original chart.

3.) CHILDCARE. Despite the unlikelihood of someone who makes $3480 a year spending $2400 a year on childcare I went with Wyatt's numbers across the board here.

4.) STATE WITHHOLDING. The State exemption for this family, as I read it, would be $12,500, so that's what's reflected. State withholding number also from Paycheckcity.com.

5.) EITC. My numbers agreed with Wyatt's with the exception of the slight difference in income.

6.) FOOD STAMPS/SNAP. I took Wyatt's number here, too. It's worth noting that for this family of three, SNAP benefits are offered (at diminishing amounts) until your income reaches about $23,800 (if memory serves) at which point they drop off completely. I found that odd -- I think I'd support more of a sliding scale. (If someone wanted it, why not offer $60/mo to a parent of two making $29,000... otherwise it could serve as a dis-incentive.) Also note that you don't qualify for SNAP if you or anyone in this family (including the kids) have a COMBINED $2001 or more in the bank. So not everyone qualifies, even if they're low income -- any savings program grandma ever set up for the kids goes to feeding them before SNAP kicks in.

7.) NATIONAL SCHOOL LUNCH PROGRAM. I didn't see any reason to dispute Wyatt's numbers. In fact, the family making $30k might technically qualify for a reduced-price lunch, but I'm not sure how to put that into a numbers, since I can't find how much the reduced-price lunch would be in Mississippi...

8.) MEDICAID and CHIP. This is the big one. Aside from miscalculating the taxes owed (and credits applied) at the top end of his scale, Wyatt's argument is really made here -- he says the net economic benefit of Medicaid is $16,500 for the family of three and he applies that at the two lower income levels, and then cuts that number perhaps to reflect a CHIP benefit for the $30k family.

Two issues:

(1) only the lowest income level may qualify for Medicaid; the full-timer @ minimum wage would only get CHIP in Mississippi

and

(2) insurance for a family of three is a whole lot cheaper than $1375/mo in Mississippi.

Here's the language from Mississippi's Medicaid program: "Adults, who are either parents or custodial relatives, certain degrees of relationship to the children, may also qualify. This is the only program which has both gross and net income maximums." The gross income number is $680/mo; net number is $368/mo.

From the TNR story: "I put the question to [Emmerich], and he told me that he got it by estimating what it would cost the family to buy private insurance on the open market if they did not have Medicaid, applying his own copays and deductible to the equation."

Like TNR, I went to ehealthinsurance.com and looked for a decent plan; low-deductible plans for an adult (I put in my b-day) and two kids was $500/mo. For the two kids alone (emulating CHIP) it was $290 a month. (For the record, I chose the CeltiCare Preferred Select PPO 80/20 Plan.) And, as TNR also notes, salaried professionals generally receive healthcare through their workplace, which is often a group plan and frequently subsidized by the employer. (On the JFP's heath plan through ChamberPlus, covering an employee and one child would cost the employee about $250 per month; based on the rates I assume another child would be an additional $100-120/mo range.)

As TNR pointed out, if you seek not to make the benefit match a reasonable replacement cost but, instead, the actual cost to the taxpayer, Wyatt's argument fares even more poorly; the average cost to the taxpayer for a Mississippi Medicaid recipient is $2510 for the adult and $1659 per child according to the story.

9.) SECTION 8. Add back in Wyatt's number if you want -- I have no idea how he got it. I can't find that on the Internet or in any calculator -- Section 8 benefits are not pegged to income (although you do have to qualify for it), the vouchers are often wait-listed, and I'm not sure how much of a benefit it is to the person who "gets" to live in section 8 or public housing; it's more a benefit to the landlord who collects the subsidy.

And if you do make the assumption that our poor family is getting a Section 8 benefit --based on some reasonable analysis of the odds that they're actually receiving it -- wouldn't it be fair to assume a mortgage interest deduction for our higher-income family?

10.) UTILITY BILL ASSISTANCE. I couldn't find a good place for this number; according to this document at LIHEAP.org (PDF) LIHEAP in Misssissippi only covered 50% of the households actually eligible for the benefit in 2010; the average benefit in 2006 was $469. Eligibility cuts off at around $27k for our sample household.

11.) NET ECONOMIC BENEFIT. I assume I'm calculating this the same way that Wyatt did. See the difference yourself. Wyatt's assertion that someone working one week per month at minimum wage experiences a lifestyle similar to someone making $60k is simply not supported. More interesting, perhaps, is the economic benefit experienced by someone working full-time at minimum wage vs. someone working full-time at $30k. (Note, for the record, though, that both are working full time.)

12.) TAKE HOME - CASH. I added this one. Here I'm taking income, subtracting the direct childcare expenses and paycheck withholding, then adding back EITC and TANF (but not food stamps, since they must be spent under certain circumstances). This is the number that seems like it would be match Wyatt's "disposable income" assertion.

...

CONCLUSIONS:

No, Toto, you don't get the same economic benefit working one week per month vs. making $60k. Or $30k. And the jingle-jangle in your pocket is different at every income level; the more you make, the more control you've got over where and how you spend your money.

What's more, Wyatt's argument really turns on two key numbers (about which he makes some dramatic assumptions) -- healthcare costs and childcare costs.

By putting those in the spreadsheet, it's become very clear to me why these numbers are such political footballs -- and why other countries solve these problems in other ways, particularly single-payer or government-based solutions that use economies of scale to make these things cheaper and more widely available. If Americans weren't forced to play "What If" with those two numbers -- healthcare and childcare -- then THAT might create the stability that Wyatt seeks in order to entice industry back to our shores.

Finally... I didn't attempt to calculate the other benefits that wealthier folks experience, like better (and cheaper) access to capital, more perks at work (401k matches, pension plans, paid leave & vacation, college tuition reimbursement, expense accounts, frequent flyer miles) -- and niceties in our tax code like the mortgage interest deduction. (If our $60k household is paying for a house, contributing to an IRA and perhaps opts for an HSA, they could significantly increase that $40k number.)

I can imagine a world where that family at $60k could buy a house and deduct the interest; borrow against it, get better terms on loans or credit cards, etc., etc., all things that make someone with higher income more mobile and more able to generate wealth. Regardless of the "economic benefit" of social programs, you simply aren't sitting as pretty as someone who is actually making decent money.

P.S. Whew!

Previous Comments

- ID

- 163208

- Comment

- Reduced price lunch: 0.40 per JPS food services http://www.jackson.k12.ms.us/content.aspx?url=/page/202 You're first family might actually qualify for free lunches.(not sure about that) Also, the two minimum wage families would qualify for child care vouchers and would not pay for child care (if they accessed those services). (I'm not actually all the way through the chart but was just catching some stuff as I was reading! )

- Author

- Lori G

- Date

- 2011-04-20T11:34:32-06:00

- ID

- 163210

- Comment

- Section 8 info: (Taken from here: http://www.affordablehousingonline.com/section8housing.asp) How much rent will I have to pay if I have a Section 8 voucher? Your rent payment is based on your income. The voucher will pay anything above 30% of your adjusted monthly income up to an established limit. For example, if you earn $2,000 per month and the home you want rents for $900 per month, you would pay $600 and the voucher would cover the difference of $300 as long as the Fair Market Rent for your area is equal to or greater than $900. To learn what the fair market rent is for your area click here. Can I choose an apartment with rent higher than the Fair Market Rent established by HUD? Yes. But you will have to pay any additional rent charges in excess of the Fair Market Rent. So, if the Fair Market Rent for the area is $800 and the apartment you want rents for $1,000 you will have to pay $200 in addition to 30% of your adjusted income.

- Author

- Lori G

- Date

- 2011-04-20T11:39:46-06:00

- ID

- 163212

- Comment

- Fair Market Rent in Jackson: http://www.huduser.org/portal/datasets/fmr/fmrs/FY2011_code/2011summary_sa.odn?inputname=Jackson,+MS+MSA*27140&data=2011 (I just keep making this more and more fun for you, don't I Todd? :))

- Author

- Lori G

- Date

- 2011-04-20T11:42:14-06:00

- ID

- 163214

- Comment

- I'd seen the stuff for how to qualify for Section 8, but I guess I'd need to put a reporter on what the wait-list is like (maybe the Delta would be a good place to start asking) and what the actually odds are of being able to avail yourself of a Section 8 voucher round-these-har-parts. That's why I took it out of the chart -- I don't think it's a sure thing. I'm curious about the Child Care vouchers -- who administers those? - T.

- Author

- Todd Stauffer

- Date

- 2011-04-20T11:50:29-06:00

- ID

- 163215

- Comment

- I also am not sure how the "School Lunch Program" is a "benefit"? Is he using what they would pay for a full price lunch and saying that is a benefit to the family? Because he's acting like they get that cash. They don't. Besides, at the high end (counting ALL days in a school year not just actual days and taking out the holiday) the top end of a "benefit" for the school lunch program would be $325.00. That is paying full price lunch for MORE than the regular amount of school days for an entire school year. That is way less than what he figured. Also, energy bill assistance from the government (human resources departments-like LIHEAP) are only available to every citizen ONE TIME PER YEAR. They will not pay it more than one time. So, whatever the one bill they pay for is how much you get out of them. That can't be repeated on the chart. If average benefit was around $500 that is all you are going to get for that year.

- Author

- Lori G

- Date

- 2011-04-20T11:53:19-06:00

- ID

- 163216

- Comment

- Department of Human Services gives out the child care vouchers. 'I don't know income limits on them. You'll have to check with them. But, they are slightly higher than Medicaid eligibility. I have an employee who is able to work part-time and still keep her voucher (that voucher for her 4 kids is more valuable than this job). And, yes, if you call HUD in Jackson and ask for a Section 8 voucher they will laugh maniacally in your face and tell you to call back in 2 years. Last I heard, 2 years was the wait. They actually stopped putting people on the list because it was so freaking ridiculous.

- Author

- Lori G

- Date

- 2011-04-20T11:56:00-06:00

- ID

- 163217

- Comment

- Also, for heaven's sake, this person making $60,000 a year is almost certain to have health insurance paid for or at least partially subsidized by the employer. The value of this benefit should either be added to the salary amount or listed under Medicaid/CHIP, which should be change to "Health benefits." The chart also completely ignores pension benefits, which are reasonably common for salaried jobs but generally non-existent for hourly-wage jobs.

- Author

- Tim Kynerd

- Date

- 2011-04-20T11:59:44-06:00

- ID

- 163218

- Comment

- Lori, how is it not a benefit to receive a product or service for free (or at a discount) instead of paying full price? You may not receive actual cash, but economically it's identical -- you get to keep the cash you would otherwise have spent on that product or service.

- Author

- Mark Geoffriau

- Date

- 2011-04-20T12:01:51-06:00

- ID

- 163220

- Comment

- Bascially, all I was saying, is that you are still being GENEROUS with the benefits, Todd. Its likely that the two lower earning families would not access or qualify for all those services. They may be available but LIHEAP had a six week wait list to get an appointment for utility assistance last I called. I could barely get JPS to give free lunches to my foster kids without fighting (they STILL made them pay some days) If your grandmother didn't apply for HUD Housing when she was pregnant with your mother you won't be any near the top of the wait list, and I "resemble" the last column and my employer pays all of my health insurance premium every month (at a $6,000.00 yearly benefit) So, I feel that even you have overestimated the benefits. *Also, the top end of my child-care spectrum ($150 a week for 50 weeks a year--$150 a week is average) still only tops out at $7500.00. I think that is grossly overestimated in Wyatt's chart. I have no idea where those damn kids are going to daycare, Prep??!!

- Author

- Lori G

- Date

- 2011-04-20T12:15:15-06:00

- ID

- 163222

- Comment

- Don't Emmerich and Todd both need to subtract what the salaried worker has to pay for housing,health insurance,utilies,food and school lunches from their take home cash?

- Author

- BubbaT

- Date

- 2011-04-20T12:44:34-06:00

- ID

- 163225

- Comment

- Also, for heaven's sake, this person making $60,000 a year is almost certain to have health insurance paid for or at least partially subsidized by the employer. The value of this benefit should either be added to the salary amount or listed under Medicaid/CHIP, which should be change to "Health benefits." Tim: Don't yell at me. ;-) I'm just trying to fix Wyatt's chart (and logic) -- this isn't my pitch. As I said in my write-up, it doesn't take into account a multitude of benefits that people with even a *little* means and cash flow can take advantage of when compared to those below the poverty line.

- Author

- Todd Stauffer

- Date

- 2011-04-20T15:05:17-06:00

- ID

- 163227

- Comment

- BubbaT- No, they paid those things themselves. We are only using "benefits". Things that they would receive that wouldn't come out of pocket. Or, someone correct me if I'm wrong.

- Author

- Lori G

- Date

- 2011-04-20T15:22:51-06:00

- ID

- 163228

- Comment

- Don't Emmerich and Todd both need to subtract what the salaried worker has to pay for housing, health insurance, utilies, food and school lunches from their take home cash? No. If the government doesn't take it out, it's take-home pay. The effect you're looking for is already implicit in the "net Economic benefit" number.

- Author

- Todd Stauffer

- Date

- 2011-04-20T15:23:35-06:00

- ID

- 163229

- Comment

- Lori, how is it not a benefit to receive a product or service for free (or at a discount) instead of paying full price? You may not receive actual cash, but economically it's identical -- you get to keep the cash you would otherwise have spent on that product or service. I totally missed this! Yes, Mark, I was wrong. In fact, I have no idea what I was saying in that comment. Seriously. I was Confucious. I was having a nutso time at work right then and think I looked at the chart and completely misread what it was saying. I think by my later comment you can see I figured it out and straightened up. Sorry. I do have some off days. But, the other 98% of the time I'm PURE GENIUS. So, it evens out. :)

- Author

- Lori G

- Date

- 2011-04-20T15:58:21-06:00

- ID

- 163233

- Comment

- Hey Todd! Didn't mean to be yelling (I DO KNOW HOW TO TYPE IN ALL CAPS), and certainly not at you. My "for heaven's sake" comment was directed at Emmerich's dishonesty or intellectual shallowness, whichever you prefer. I think your chart could be adjusted to reflect what I mentioned, but the animus was directed at him, not you! I didn't see the end of your write-up until I had already posted my comment (bad me), and I shouldn't have mentioned the pension thing, which you explicitly said you weren't taking into account. But I think it would be helpful to remedy Emmerich's (deliberate?) omission of health insurance benefits for better-paid jobs, for better comparability of the various situations. :) Best, Tim

- Author

- Tim Kynerd

- Date

- 2011-04-20T20:04:46-06:00

- ID

- 163234

- Comment

- I think both your charts are wrong. LOL Disposable income= Gross Income- Taxes. $15080-$1154=$13926 $60000-$7542-$2064=$50394 That's their disposable incomes. I wouldn't include the foodstamps,medicare any other benefits in the minimum wage workers income because they aren't recieving that in cash and none can't be used for anything else. If I was going to include them, I would think you would have to deduct the cost of the same items from the salaried workers income. But then you woud be figuring discretionary income. Discretionary income = Gross income - taxes - necessities. Anyway a minimum wage worker doesn't have nearly the same disposable or discretionary income as a $600000 salaried worker, no matter how you figure it, without playing with the numbers.Just my thoughts. Where did ya'll get the school lunch figure? I pay full price for my daughter's and it no where near $1800 a year,it's more like $700.

- Author

- BubbaT

- Date

- 2011-04-20T22:00:44-06:00

- ID

- 163237

- Comment

- Thanks Bubba, interesting thoughts. For the record, I'm not actually arguing a "case" in my chart -- my point was to correct the mistakes in Wyatt's chart, as it stands, not to actually assert mine as particularly useful. (I think Wyatt's premise is flawed, and I think his own chart shows it, which is why I updated his chart but stuck fundamentally to his numbers. As I've said, I think there's a lot more you could add to this, such as mortgage interest deductions, pension benefits, healthcare benefits from your work, etc.) For instance, I agree with you that "discretionary income" is the wrong thing to call it; that's why I went with "cash" to make the point. You could argue, in fact, that the childcare number is "cash" initially and you'd be right, but then that would affect the tax numbers since you part of the Federal withholding number is based on childcare credits, so you'd need to rework that before your "disposable income" number is accurate. (Just FYI. ;-) From my notes you'll see that I simply said I couldn't dispute the school lunch figure. I don't have kids and have absolutely no frame of reference for how much a school lunch costs. (I'm not even sure how many days per year kids go to school anymore. ;-) If anyone else has adjustments like that I'm happy to try to keep up with the changes and post another chart.

- Author

- Todd Stauffer

- Date

- 2011-04-21T09:03:33-06:00

- ID

- 163238

- Comment

- Tim: I know you weren't really yelling at me, I was just playing. I don't know what's deliberate about Wyatt's choices in his chart and what wasn't; I'm curious to see if we'll hear from him now that the numbers are side-by-side.

- Author

- Todd Stauffer

- Date

- 2011-04-21T09:04:36-06:00