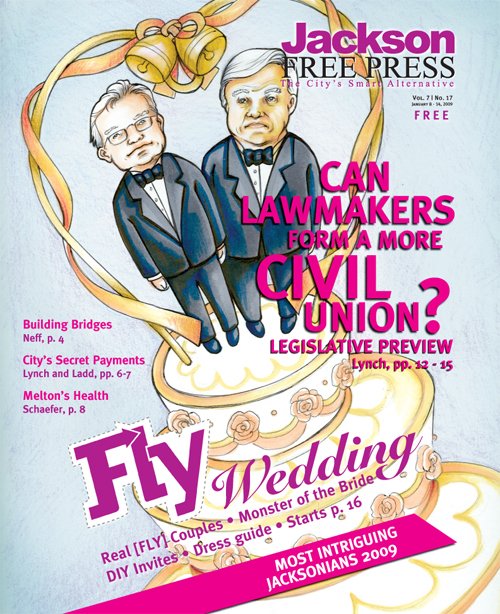

House Speaker Billy McCoy, Senate leader Lt. Gov. Phil Bryant and Gov. Haley Barbour will address some very old fights this year as the Legislature convenes. Many of these are battles that never seemed to get a resolution in past boutsnot even after exhaustive special sessions.

Resolutions are unlikely to come any easier this year, with the national recession hitting the state's revenue shortfalls in a big way. Barbour already announced $41.9 million in cuts for most state agencies in his FY 2009 budget revision, which amounts to almost 2 percent of the entire state budget. Mississippi, he said, is expected to suffer a 2.3 percent revenue plunge in 2009, and state law demands he balance the budget.

"By cutting $41,970,231 in state spending, we are fully offsetting the revenue shortfall through October 2008, or one-third of the fiscal year. It is likely revenue will fall short of the FY 09 estimate in the future, and further cuts in these or other programs, agencies or departments may be necessary later in the fiscal year," Barbour said in a statement.

Barbour said the 2 percent adjustments protect priority agencies, including the Mississippi Adequate Education Program (MAEP), Medicaid, and social and health services.

Class is Out

K-12 education could still suffer serious shortfalls this year, however, despite Barbour's personal commitment to fully fund MAEPthe program that redistributes state money to smaller school districts with less revenue, which often contain under-performing schools with serious resource deficits.

The Mississippi Department of Education estimates that full funding MAEP in FY 2009 means kicking in an extra $61 million, which doesn't include $38 million in building maintenance and teacher supply funds that the MDE requested the state restore this year. Legislators have been squirreling away money from the building-maintenance and teacher-supply funds for yearseven during the years they refused to fully fund MAEP. The diversions forced schools to cut back on building repair, and sometimes even resulted in students having to leave textbooks at school.

MDE's total budget request, which also includes a 3 percent teacher pay raise and a plan to renovate the state's high school system, is for $180 million more than it got in FY 2008.

Legislators appear fully behind MAEP this year. Sen. David Blount, D-Jackson, said he doubts legislators would cut the program. "We made a commitment to fully fund it during this past legislative session, and we shouldn't come back a few months into the year and make cuts. I believe we have the votes to maintain full funding."

Barbour made no such commitment to any other funding, however, including the raided maintenance and school-supply budgets.

Democrats are likely to stand behind pubic education as an investment of the future, while Republicans will oppose extra funding for the sake of balancing the budget.

"Once we (fund MAEP), I'm not sure what's going to be left to fund other education proposals," Senate Appropriations Chairman Alan Nunnelee, R-Tupelo, told The Clarion-Ledger in December.

The Legislative Task Force on Underperforming Schools and Districts, established in the 2008 Legislative session, devised several recommendations for helping underperforming schools and will present its results to the Legislature in the Children First Act of 2009 when the new session begins. One of those recommendations was for granting the education department the ability to remove the superintendent and board immediately when school districts underperform for two consecutive years.

The proposal calls for the state to then appoint a "conservator" to run the daily operations while the district becomes a part of the Mississippi Recovery School District.

Requisitioned districts, according to the recommendations, would remain a part of the Mississippi Recovery School District until the district sees "sustainable change."

Bounds called the idea radical, but approved it, saying it allowed the state to step in "before the district crashes and burns," rather than afterward. "We know the only way to break the cycle of poverty is through a quality education. This is the one tool we must ensure that every child is armed with when they reach adulthood. It is the one tool that will improve their lives and the lives of all Mississippians," Bounds said in a statement.

Money Follows the Person

The House Public Health Committee will deliver a counterpunch to follow up the Legislature's 2007 passage of a "money follows the person" law, inserted in the 2007 Medicaid funding bill. The law demands the Medicaid division authorize funding for stay-at-home care, in addition to institutional health care for the state's aging and mentally ill.

Stan Flint, managing partner of Southern Strategy Consultants, a lobbying firm working with the Mississippi Society for People with Disabilities, said the Medicaid director has, so far, refused to follow the Legislature's desire in passing the "money follows the person" law.

"I think the 'money follows the person' issue will be a big agenda item for the Medicaid committee and the public health committee," Flint said. "We have the highest percentage of population in nursing homes than any other state in the country. ... [W]e're going to have to move the people who are capable of enjoying home-based care into home-based care and keep the nursing home beds from being backfilled with people who qualify to be at home."

The Centers for Medicare & Medicaid Services recently backed up Flint's argument, saying the federal government stood to save considerable money if more states would push their programs to facilitate stay-at-home care over institutionalized health care. In 2006, CMS announced it would give states a total of $1.75 billion over five years to "help shift Medicaid from its historical emphasis on institutional long-term care services to a system that offers more choices for seniors and persons with disabilities from all age groups, including home and community-based services."

The CMS "rebalancing" initiative was part of the Deficit Reduction Act of 2005, but was also a part of President George Bush's New Freedom Initiative.

"With this program, people who need long-term care and prefer to live in their own homes and communities can do so," said CMS Secretary Mike Leavitt in a statement. "States will also get more for their money by giving the elderly and people with disabilities more control over how and where they get the Medicaid-funded long-term care services they need."

The federal government is willing to pay 75 to 90 percent of the costs of transitioning individuals out of nursing homes and into community settings, and the associated long-term care benefit costs. But the nursing home industry loses money when people opt for stay-at-home care, and the industry has a powerful lobby in the Mississippi Legislature. It pushed Division of Medicaid Executive Director Robert L. Robinson to ignore both the law allowing the Medicaid diversion for home care and the federal money that Leavitt authorized.

"They had the money right there, and they just pissed it away," Public Health Committee Chairman Steve Holland told the Jackson Free Press. Holland, whose father suffers from Alzheimer's, pressed for the passage of the state "money follows the person" amendment to the Medicaid funding bill during the 2007 legislative session.

Flint said the coalition for people with disabilities may have an easier fight this year. "The president of the United States and the Centers for Medicare & Medicaid services has sent letters to every state director, instructing themor downright ordering themto move toward a home-based model. Even the supreme court has ordered care in the most integrated setting possible, so the future is moving out from under the nursing home industry if they don't adapt to embrace this model," Flint said.

"We say to the nursing home industry, 'be on the crest of the wave instead of getting swallowed by it.' Right now the nursing home industry makes money by building an expensive facility, paying for the electricity, the air-conditioning, providing health care and security in a 24-hour dormitory. The truth is they can make more money taking care of people at home than by jamming them into a medical facility."

Hospitals v. Cigarettes, Again

The battle over how to fund the state's re-occurring Medicaid shortfall may kick up again this year with a fight over whether to fill it with an increased tax on hospitals or on cigarettes. The $90 million shortfall is nothing new, but federal money to offset the damage of Hurricane Katrina had plugged the deficit until last year. Now that the Katrina money has run out, the state desperately needs to find a source of annual money to fill the deficit.

When the JFP addressed the issue in August, Barbour was pushing a plan to increase the gross revenue assessment on hospitalscompletely without legislative approvalto fund the deficit, while many of the state's hospitals were battling in court to stop him.

The Mississippi Hospital Association warned that Barbour's 1.08 percent gross revenue assessment plan (up from 0.45 percent) would pay some hospitals less than $500 per day for treating Medicaid patients while paying more than $25,000 to others.

Rep. Cecil Brown, D-Jackson, opposed the Barbour hospital tax and echoed the MHA in saying that the unbalanced plan would put many hospitals out of business.

Barbour gave an ultimatum earlier this year, however, threatening to cut $375 million from hospitals if House Democrats did not agree to the hospital tax, while they screamed for Barboura former tobacco lobbyistto agree to raise the state's 18-cent tax on cigarettes. But in September, after a grueling May special session that still delivered no agreement, Barbour announced the discovery of one-time money to fill the $90 million hole.

House members ordered Barbour to compromise on a combination of a $45 million cigarette tax and a $45 million hospital assessment, but he said his original plan was already a compromise.

"Let me just remind you: What the Senate passed in the special session was compromise. I had proposed we raise the money through gross revenue assessment, the hospital association didn't like that, and they developed their own solution. The Senate came to me and said we think it's a good solution so I supported the hospital association plan," Barbour said, dismissing any suggestion of tweaking the plan to make it more palatable for the hospital association. "We already took the hospital association's plan. That's not tweakingthat's swallowing."

Sam Cameron, president of the Mississippi Hospital Association, says some hospitals could go out of business under the Senate plan, but that the hospitals accepted the plan only as a preventive measure to stave off the tragedy of $375 million in cuts to Medicaidthat is until the House offered a better deal.

"The governor keeps stating that hospitals need to pay their fair share, but hospitals are already paying 72 percent of the match that the state uses to draw down the federal funds for the hospital portion of the program. To continually state that we're not paying our fair share is not correct," Cameron said, adding that MHA will still be pushing for the House's 45/45 plan in 2009.

The governor ended the 2008 battle when he announced that a five-year-old clerical error had resulted in the state annually paying about $18 million more than necessary on Medicaid. Barbour said the federal government had agreed to return the moneyconveniently refunding about $92 million. The governor told reporters that he had suspected the clerical error would deliver this small windfall, but had been slow to report the information until the federal government agreed to pay it.

That refund, a one-time fix, means the fight starts anew this year, and House Democrats are already staring hard at tobacco, egged on by Medicaid and anti-smoking advocates.

Barbour has opposed countless attempts by the Legislature to raise the incise tax on tobacco products, but stepped out from behind his friends at Philip Morris in November to advocate a tobacco tax increase this year during the 2009 session. However, he wants the money to go to the general fund to offset the expected decline in state revenue.

The state's existing tax is 18 cents per pack, the second lowest in America. Barbour's proposal of a 24-cent per pack increase on cigarettes is a generous bow to tobacco companies, even compared to other nearby southern states. Arkansas, for example, raised their taxes 59 cents in 2003, while tobacco-loving Texas raised its tax to $1.41 in 2007. Other southeastern states' Legislatures are also considering tobacco tax hikes. Georgia, Kentucky and Florida are deliberating it in 2009, while North Carolina, Texas and even Virginia have put the issue on the table for 2010.

Holland wants revenue generated from cigarette sales to go directly to Medicaid to offset expenditures on tobacco-related illness.

Alice Dember, a communication analyst with Community Catalyst: Alliance for a Healthy South, in Washington, agreed with Holland, if not strictly for economic reasons. Dember pointed out at a December joint committee meeting that the state stood to gain almost $1 billion in business activity if it hiked the tobacco excise tax up a dollar to $1.18 and put the resulting $174 million in revenue into the Medicaid program, because the federal government matches Mississippi's Medicaid money $3 for every $1.

"If you raise the tobacco tax and put the money completely to Medicaid the state would essentially create a 'perfect storm' to infuse the state's economy, effectively erasing the state's $90 million Medicaid deficit."

Dember said that $174 million would finance 11,000 jobs and $381 million in wages and salaries: "The way that works is if you put more money to Medicaid, you're providing more funding for health care providers, doctors, nurses, nurses aids, nursing homesall of that is putting additional money into the economy and giving people jobs that they will then have to spend on food or other necessities, perhaps even some small luxuries that will contribute to the economy. It's a cycle that builds onto itself every year, again and again."

Barbour disagreed at a Jan. 5 press event, calling the federal matching funds unreliable. "The problem is if the federal government cuts the state matching requirement we could end up with a hundred and something of our money over there that doesn't generate a penny, because you got to spend it on Medicaid, not budget it on Medicaid. And we're not going to spend money on a program, just cause it's a good deal by the government match," he said. "The problem is the federal government changes the rules every now and then."

Dember said the state would reduce the cost of health insurance for everyone, since the cost of covering the uninsured in most states is partly financed by federal dollars and partly by people who pay for private insurance.

Anti-tobacco group Communities for a Clean Bill of Health claims the state would also benefit from $1 billion in long-term health-care savings earned by reducing the use of tobacco in adults and youth.

Cigarettes are feeling it from all sides. Rep. John Mayo, D-Clarksdale, says he will submit legislation during the 2009 session calling for a statewide tobacco ban in public places, which could end smoking in most enclosed public places, including restaurants and bars.

"The benefits to the state in banning smoking in public places are too numerous to ignore the issue," Mayo said last month.

Thirty cities across the state, including Laurel and Ridgeland, have already passed local smoke-free ordinances, though the American Cancer Society says such laws protect only 9 percent of Mississippians, and wants the state to join the 26 other states and the District of Columbia that already boast statewide smoke-free laws.

State Health Officer Ed Thompson endorsed Mayo's legislation, pointing out the dangers of second-hand smoke in December: "The U.S. Surgeon General issued a report in 2004 saying there was no safe level for environmental second hand smoke. No matter how small the amount, it increases your risk of health problems. Even separate ventilation systems without separate rooms do not make a significant difference."

The Mississippi Restaurant Association says the ban will cause a drop in restaurant patronage, as do representatives of the casino industry, who claim smokers too often go to nearby casinos that do not suffer a ban.

Rep. Bobby Moak, D-Bogue Chitto, chairman of the House Gaming Committee, predicts an amendment excluding casinos. "I have every reason to believe that the casinos would not be included in that," Moak said.

Mayo is expecting pro-tobacco advocates to add a "poison pill" to his legislation in the form of a local government exemption. "If they add some kind of preemption clause that says local governments can't enact their own ordinances that are more strict than that of the state law, they'll weaken the state law to the point where it won't do any good," he said.

'A Moronic Farce'

Barbour's recommended budget cuts for FY 2009besides directly sparing MAEPalso sidesteps Medicaid and the state's social and health services. But this does not mean the state health program, which oversees about 600,000 poverty-level or disabled individuals, will meet its full potential this year.

"Barbour's recommendation may not directly touch Medicaid, but that doesn't mean the program is completely healthy," said Roy Mitchell, program director for Mississippi Health Advocacy. "The whole reason we got into the argument over the cigarette tax was because of a detrimental need for more revenue for Medicaid. With the economic crisis, there's going to be growing demands on the program. Every state across the board is showing increased enrollment on Medicaid programs, and there's no reason for us to expect any different here in Mississippi."

Mitchell said Robinson acknowledged this much himself, and advocated restricting access to the state program in a response to the possibility of increased enrollment.

He noted that MDHS posted a December notice that they intend to ask the legislature to implement a statewide Medicaid managed care program that would be mandatory for what they call 'high-cost eligible recipients.'

The target population includes pregnant women, children under the age of one year and other high-cost Medicaid beneficiaries, as identified by Medicaid claim statements.

A legislative PEER committee report came out in 2008 that also suggested increasing cost sharing, prescription drug containment and enrollment controls. Mitchell said he fears what the term "enrollment controls" entails. The state is already one of the few states engaging in a "face-to-face" Medicaid re-registration policy, wherein a Medicaid beneficiary must meet with Medicaid personnel every few months to verify their eligibility.

Holland called the program "a moronic farce" because most of the beneficiaries booted off the program because of a missed face-to-face appointment actually do qualify for eligibility and do successfully re-enroll at a later date. "The truth of the matter is Mississippi is a state with more poverty than most. You can't be surprised when someone actually qualifies for Medicaid," Holland said. "What did you expect?"

Mitchell said the state should be embracing the incredible federal Medicaid match, especially when other states were already buckling down to meet the growing national poverty with their own state-financed medical safety-nets.

"We spend so much of our time just mending the safety net in Mississippi. While other states are looking at shoring up their programs, getting ready for increased enrollment, we in our state seem to be heading the opposite direction," Mitchell lamented.

Lt. Gov. Phil Bryant held a press conference last week during which he opined that any new revenue generated by a cigarette tax should be put toward cuts in income, inventory or property taxes, a view that infuriates Mitchell "because a state tax cut of any kind generates no 3-to-1 federal match."

"In this economy, that makes no sense at all. We know we're going to have a Medicaid deficit. Let's take care of that," Mitchell said. "You talk about economic stimulus? Almost a billion in annual money would turn our economy like you wouldn't believe."

Barbour said that he would not be adverse to a tax swap: "If (the tobacco tax) is offset with other tax cuts, that's certainly consistent with my philosophy and my stated goal that before I go out as governor we will have net tax cuts during my eight years as governor."

Voter ID

It would not be Mississippi if legislators were not knocking around the prospect of making voter ID mandatory.

Republican Secretary of State Delbert Hosemann recommended to the Senate Elections Committee in December that Mississippi voters be forced to produce some form of identification at the polls, such as a driver's license or an official state-issued ID. Other verification could include a U.S. passport, a federal, state or local government employee ID card, school ID, a state gun permit, pilot's license or official voter registration card.

Then, as now, Republicans champion voter ID as a means to clean up counties' "bloated" voter rolls, while most Democrats say the new rule is unneeded regulation that could disenfranchise black and elderly voters, who may not have easy access to ID and may not be aware of the law changes in time for the next election.

As evidence for voter ID, Senate Elections Chairman Terry Burton references the November 2007 voter fraud case of Lindsey v. Darbyan absentee ballot voter fraud case in Tunica County wherein officials found at least nine ballot envelopes containing no ballots, one confirmed dead voter attempting to vote and nine confirmed absentee voters claiming they had not voted those absentees.

"I have heard several times 'show us proof,' and if we've got a judgment that was issued that's proof," Burton stated. "I think it ought to be part of the record." Neither of these cases would have been stopped by ID, but Burton insists on referring to the case as "an argument to clean up the process."

Hosemann also wants the Legislature to grant his office subpoena power to investigate alleged election fraud and the power to commandeer any county election commission "found in default" of not pursuing Hosemann's vigorous purge on county voter rolls.

Attorney General Jim Hood's office and county authorities already have subpoena power to take on election fraud. Hosemann's request could amount to a duplication of duties, though some Democrats suspect the secretary of state could use the information to elevate baseless allegations against voter assistants and election officials.

Money for the Capital City

The city of Jackson is hoping to cover some holes in its budget with the help of the Legislature this year. The city, which is facing severe cuts in its police and infrastructure budgets, had adopted a scatter-gun process in the past of lobbying for both one-time money and annual funding, but the city is settling this year to pack all its eggs into one basket.

"I've recommended to the council that they focus on one request, not the shotgun approach or the menu approach. I project we come together with what the administration and the council thinks is most likely to succeed, and leave the rest of it for another year," said Flint, the city's lobbyist.

The city will consider one of three possibilities: the authority to raise the local sales tax and divert that money to the city; an option to divert a greater amount of the current sales tax generated in the city back to the cityas opposed to state coffers; and a straight appropriation based on the city's tax losses due to the high number of untaxed government and non-profit buildings within city limits.

The first option would be a 1 percent citywide sales tax that exempts pharmaceutical sales, hotel rooms and groceries. State municipalities can raise some fees without legislative input, though a straight up increase in the local sales tax still needs legislative approval. The second option for a one-time appropriation has everything to do with untaxed property inside city limits, which currently makes up about 40 percent of all property in the city.

Ward 6 Councilman Marshand Crisler, who may announce a run for mayor this year, repeatedly references the high percentage of untaxed property in his legislative rants.

"That 40 percent you're talking about there, that's dead property to the city," Crisler said in August. "We get nothing from that. All those nice buildings that the city provides for the governor, and the legislature, and the Department of Finance and MDHS, all the way downwe get nothing from that. But you can bet they'll be calling our firemen to go put out their fires, or our cops to come deal with crime in their parking lots. They'll even be using our water and sewer lines, but the city gets nothing back in return beyond the ability to say 'they're here.Ҕ

The third option involves no tax increase at all, but requires the state to relinquish a bigger portion of sales tax generated within city limits. The city currently retains 18.25 percent of the sales tax, though Flint said getting money out of legislators this year will be difficult because of economic downturns.

"I've got a well-worn flat spot on my head from beating my head against the wall on funding, and that certainly won't be any softer this year," Flint said.