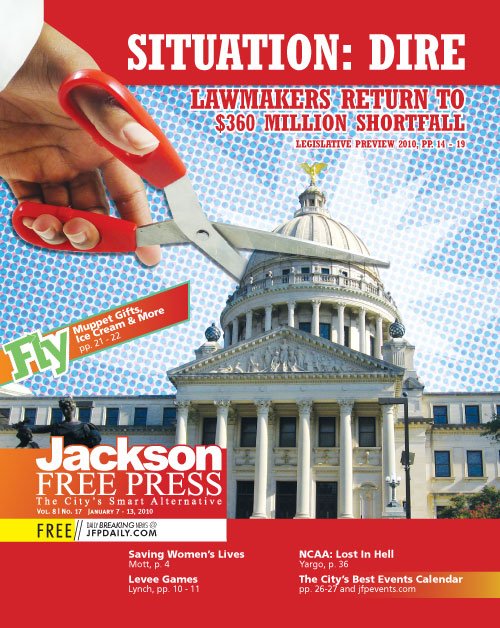

Mississippi legislators skulked back into the state capitol Jan. 5, keeping their body movements at a minimum and their heads low in case somebody noticed them and asked them questions containing the words "budget shortfall."

In November, Gov. Haley Barbour announced that Mississippi is on its way to the kind of revenue deficit unseen since the Great Depression. Revenue estimates ended low for more than 16 months in a row, falling more than $136 million since July, with officials predicting a $360 million shortage by the end of fiscal year 2010.

Barbour responded to the news with a new round of budget cuts this winter, which, added to earlier cuts he instituted in September, amounts to more than $220 million in budget reductions. This is nothing new as the national economy continues to slump. The governor cut $200 million from the budget in fiscal year 2010, and some state agencies are now operating at about 10 percent below their funding from last year. Many state workers are nervously submitting resumes to the private sector or out of state, in anticipation of salary freezes, slashed hours or even lost jobs.

The news got around quickly. The Joint Legislative Budget Committee followed through with its own plan to deal with revenue shortfalls last month. Committee members agreed to defund all vacant state job positions and permanently delete 3,656 of them. They also agreed to reduce travel and contractual service.

The committee's fiscal year 2011 budget recommendations include a 10 percent blanket reduction for all state agencies and, most painfully, nearly a 6 percent reduction from the Mississippi Adequate Education Program. MAEP is the formula through which the state steers money to low-revenue school districts that do not produce enough cash through sales taxes to adequately fund teachers' salaries and learning materials.

Nancy Loome, executive director of K-12 advocate group The Parent's Campaign, warned that cuts to the funding formula mean cuts that can't easily be recouped in subsequent years.

"When you have cuts of that magnitude, it pretty well necessitates a reduction in staff, so you're talking about increases in class size, and we know that class size has a direct impact on student achievement," Loome said. "When students fall behind in one year, they are losing some of that foundation that they need for subsequent years."

Though painful, the legislative budget plan for education is slightly more generous than Barbour's own suggestion to reduce MAEP by 10.9 percent in fiscal year 2011and his recommendation to cut K-12 education 12 percent across the board. Barbour's cut would actually amount to a cut of about 15 percent according to House Education Committee Chairman Cecil Brown, D-Jackson. Brown agrees with Loome's argument that MAEP was rightfully due for an increase next year, which certainly won't be happening under the current circumstances. Barbour also recommended a cut of almost 70 percent to vocational education programs, as well as programs for special education and the giftedequal to a $176 million loss in federal funds.

Crisis-Generated Cooperation

Lobbyist Stan Flynt said the overall push of the legislative session this year will unquestioningly center on making ends meet.

"The shortage of money will be the driving force this time around, and I think we'll all be amazed at how well legislators will come together to try to battle this issue," said Flynt, who predicted that any rogue attitudes not specifically attuned to the greater crusade of removing red ink will suffer for it the following year.

"I attribute it to self-preservation more than anythingcrisis-generated cooperation. If that turns out not to be the case, then my political instinct tells me that it will be to the detriment to all involved. The year 2011 is an election year," Flynt said.

"Don't think these politicians don't know it. Anybody who doesn't get with the greater program will have competitors beating them for that attitude in the primaries. Voters will do their part, too, because if these guys don't get alongand get along fast on the budget problemsvoters will adopt a blanket 'throw the bums out' attitude toward them in 2011."

Flynt used the Joint Legislative Budget Committee's recent plan as an example of how willing legislators are to work together to battle the common foe of budget shortfalls. The joint committeecomprised of a progressive cadre of Democratic House members and a considerably conservative branch of the Republican-dominated Senateshook hands on a budget plan within the course of 72 hours. The usual process takes days, sometimes weeks of back-and-forth reconnaissance, as well as the occasional complaint to the media about the other team's unwillingness to play ball.

Savings will be a big call to arms this year, and Public Health Committee Chairman Rep. Steve Holland, D-Plantersville, said he will see if Barbour is taking serious his own call to steer Medicaid money to home- and community-based nursing, rather than the more expensive institutional nursing care that the state's high number of nursing homes offer.

Holland said a simple slashing of Medicaid is the wrong way to fix a shortfall, especially considering that Medicaid is a program where the federal government matches every dollar the state invests three times over.

"Cutting the Medicaid budget is a three-to-one loss to the state," Holland said. "I never understood the argument to reduce it."

Barbour advised the state to divert Medicaid money to more affordable home-based nursing services instead of nursing homes as a means to cut state costs. Barbour's demand arrived two years after Holland and lobbyists for the handicapped and disabled passed "money follows the person" laws allowing the state to use Medicaid money for private nursing. Holland said the Division of Medicaid has been slow to actually use the law, influenced perhaps by the powerful nursing-home lobby, which is partly comprised of the even more commanding health-care lobby.

For the two years money-follows-the-person laws have been in the books, the nursing-home lobby has argued that the state does not have the infrastructure to monitor a growing mass of private nursing businesses, and that the largely rural state still does not offer home-care nursing services in many of its sparsely populated communities. About 80 percent of the population has access to some form of home-care based health-service, but there currently are not enough nursing services to handle the kind of institution to home-care changeover the governor envisions.

Flynt says legislators will probably be trying to assemble that infrastructure soon in an effort to cut the costs that the governor now demands.

"There are two ways to save the state money when it comes to essential programs, and Medicaid is going to be one of the center issues in this session," Flynt predicted. "We can save anywhere between $60,000 to $150,000 per Medicaid recipient per year through home-care nursing, and provide them services that are closer to home and relatives and their network, with the possibility that they can even go out and work and generate income and taxes."

Barbour also called for the expansion of the Mississippi Coordinated Access Network, known as Mississippi CAN. The governor said the coordinated-care program, which serves state Medicaid beneficiaries, should "improve access to needed medical services by connecting beneficiaries to providers for preventative and primary care," and will provide "support services for managing illnesses and empower beneficiaries."

Mary Troupe, executive director for the Mississippi Coalition for Citizens with Disabilities, lauds the proposed expansion, arguing that beneficiaries need an organizer to help them fully utilize Medicaid services.

Many kidney dialysis patients who are Medicaid beneficiaries, for example, do not know that the state offers free transportation to the location of dialysis treatment. Many of these patients, Troupe said, end up calling the offices of the Mississippi Coalition for Citizens with Disabilities to learn this kind of informationinformation that should already be widely available through a coordinated program manager.

Both legislators and health advocates acknowledge that expanding Mississippi CAN and extending private nursing service to previously un-serviced areas will not be a one-year project. Legislators could spend this session hashing out a plan to take services where they do not currently exist, while next year could potentially be when the infrastructure for such a plan begins to come together. Full utilization could take years, especially since the state has been working for decades under an entirely different kind of health infrastructure that demands the existence of brick-and-mortar nursing homes and institutions, complete with expenses such as air-conditioning, security service, lawn care and countless other forms of maintenance fees.

Flynt and Holland said changing a fossilized health-care system like this is no easy process, although the current financial calamity is precisely the kind of environment that could begin the process.

"Chaos is the friend of change," Flynt said. "When the status quo is rocking along, it's virtually impossible to accomplish significant change. It's only during chaos and crisiswhen a significant number of people are hurting, everybody is questioning their fundamental operating principals and having to be forced to reevaluate everythingthat change comes."

Fee Hikes and Soda Taxes

The Joint Legislative Budget Committee, headed by Lt. Gov Phil Bryant, stuck with the argument this month that raising fees on state services does not qualify specifically as taxes. Both committee members and Bryant boasted that they steadfastly refused to raise any taxes whatsoever, even while raising fees on vehicle titles and limited liability company filing fees with the secretary of state's office.

"That was the first thing we agreed on," Bryant told The Clarion-Ledger. "The worst thing we could do right now is increase taxes."

The committee anticipates generating $10.6 million through the fee increases, which will mean raising state charges to produce certificates of title for automobiles from $4 to $16, and a fee increase for annual filings for limited liability company filings. Car tags also could face a substantial increase next year. The committee made no effort to mandate money for the state's car tag subsidy fund, state money that reduces the cost of car tags on the local level.

Rep. Kelvin Buck, D-Holly Springs, voiced concern last year after warning that legislators will consider axing the $27 million program.

"It'll be like passing a tax on the local level while wiping your hands of it at the state level," Buck said. "There's a subsidy that the state has been doing. You'll see it on your tag receipt when you pay for your tag. If it were not for that subsidy, your tag would be considerably more expensive each time you went to buy it. I don't think people want to see their car tags jump up in price, certainly not now."

Legislators established the subsidy program in the mid-1990s, and felt the program warranted enough importance to steer a portion of the recent tax increase on tobacco products (an increase from 18 cents per pack to 68 cents per pack) to the fund. The $27 million influx became necessary after the state Tax Commission decided to decrease the annual tag discount for car owners from 5.5 percent to 3 percent.

Rep. John Mayo, D-Clarksdale, plans to introduce one potential revenue measure, a 2-cents-per-ounce tax on soft drinks, in the hopes of combating obesity. While acknowledging the potential unpopularity of another tax, Mayo argued that the tax is simply compensating for the social cost of obesity and related complications like diabetes.

"Obesity costs Mississippi taxpayers over $900 million a year," Mayo said. "Doesn't the state have a responsibility to be good stewards of the taxpayers' money?"

Mayo's House colleague Steve Holland, D-Plantersville, supports the idea of a soda tax, but he is less than sanguine about its chance of passage.

"I don't think there's going to be much of a climatequite franklyto do revenue this year," Holland said. "I don't think we're going to pass any tax because we've still got a damn Legislature and a governor full of Republicanism, and they're not going to pass sh*t. It's just a bad time, let's face it, to do any of that."

While the legislative committee refused to acknowledge the governor's call to merge the state's main historically black colleges and universities, the committee did follow through with Barbour's recommendation to privatize the wine-sale functions of the Tax Commission's Alcohol Beverage Control Division. The committee believes the move will generate $2.5 million in new revenue for the state, as Barbour claims in his recommendation, although a source familiar with the ABC division suspects the changeover will be anything but cost-saving for wine sellers.

The Tax Commission's Alcohol Beverage Control Division regulates wine sales by retaining the inventory of all the wine sold in the state. Any private contractor must therefore be willing to make deliveries once a day to wine sellers, whether they are liquor stores or restaurants. These deliveries might not make for a lot of volumeeach can contain as little as five cases of winebut they do feature an intimidating degree of variety. A company adopting ABC duties must also be willing to stock a daunting volume of largely unused inventory to meet the needs of wine sellers.

Critics say a private company may not be able to manage the task without adding fees on top of current fees charged by the state.

Legislators will look at any number of revenue generators this year. House Gaming Committee Chairman Bobby Moak, D-Bogue Chitto, said some lawmakers are considering revisiting the possibility of instituting a state lottery to help fund higher education.

"I've had different members of the House ask about the possibility of beginning a state lottery. I even think the prospect would pass in the House," Moak said. "But the governor has made his reluctance to support a state lottery known. So to avoid a veto, we would have to wait for the Senate to get behind the effort if it stands a chance."

Opponents of a lottery, like the governor, argue that people with less income are more likely to play the lottery; essentially making them victims to a venture that is, by design, unlikely to award them any benefit.

"When you read that the governor is going to veto any (lottery) legislation that you pass, you've got to take a look and ask yourself if this is worth the effort. Nevertheless, this is the kind of economy where people are asking about it and questioning about it."

Some legislators may also consider looking at state subsidies. Ways and Means Committee Chairman Percy Watson, D-Hattiesburg, discovered about three years ago, after a PEER study, that the state hands off about $1 billion in annual subsidies, from homestead exemptions, to subsidies for farm equipment purchases.

Most people in the state are eligible for some form of tax subsidy. Even the state's car tag fund counts as a kind of subsidy. Tampering with the popular homestead exemption is likely a no-no, in any case, but not everybody can successfully argue for the money they get when forced to explain it. Exemptions for tractors, for example, don't just go to privately owned small farms. The state allows exemptions for farm equipment, fertilizer, cattle food, and seed and grain exemptionsmany of which get claimed by agribusinesses.

"If there's one place the state can cut the fat and make people justify government giveaways, besides Medicaid, they need to look at government welfare put out in the way of exemptions. It's government largesse, and it needs to be examined from top to bottom," Flynt said.

"Why not launch an exemptions review, and require anybody with an exemption to come in and justify the exemption. Let's just do an audit of them and see what benefit they create for the state. If you only knock out a third of the exemptions that aren't found to be productive, then you're talking about $333 million saved."

Even if the state manages to whittle out one-tenth of junk exemptions, Flynt says it will save enough money to more than fill the $60 million Medicaid shortfall.

Education Wars

One of Barbour's most controversial agenda items for the 2010 session appears dead-on-arrival: His proposed consolidation of the state's eight public universities has yet to attract vocal support in the Legislature. Barbour called for merging two of the state's historically black universities, Alcorn State and Mississippi Valley State, into its third historically black institution, Jackson State University. He also proposed that the Mississippi University for Women merge with Mississippi State University. Kelvin Buck, who chairs the House Universities and Colleges Committee, has vowed to kill any bill that would consolidate state universities.

"I won't support any bill that comes out that would be designed to consolidate any universities," Buck told the Jackson Free Press in November. "It's not my plan to even entertain it, to be honest with you."

Barbour has proposed consolidation not only at the university level, but also in K-12 education. In December, he announced the formation of a special advisory commission to review the structure of the state's public school districts and recommend how they can be consolidated.

"The state's educational structure is a model of inefficiency with 152 school districts in only 82 counties," Barbour stated in a Dec. 21 press release. "By consolidating districts, we can make sure state and local tax dollars are spent on educating our students and increase the quality of educational opportunities for Mississippi's children."

The commission will recommend how to best achieve consolidation and will calculate any resulting savings from the mergers. Barbour recommended reducing the state's total number of school districts down to 100, although Rep. Cecil Brown, D-Jackson, doubted the U.S. Department of Justice would clear many consolidations, considering the state's racist history.

Brown doubted the state could select 50 districts to merge that wouldn't include some majority-white districts fusing with some majority-black districts, which will inevitably call into play voting rights issues.

"Let's just say you want to merge Canton into Madison County. You've got a substantially majority-black district moving into a much, much larger majority-white district, and all of a sudden you've diluted the black voting strength. Is that going to pass muster? In a large number of those (consolidated districts), that's going to be an issue," Brown said.

School districts use different methods to install school board members, with some appointed by elected officials and others directly elected by the local population. The state could step into voting rights issues if mergers result in white elected officials in a different district usurping black elected officials.

Brown is one of the members of Barbour's committee, although he doubts the committee's report, which is due April 1, will have any kind of impact on this year's legislative session, which ends in March.

Mayo intends to introduce legislation putting charter schools under the guidance of the Mississippi Department of Education. Mayo remains suspicious of charter schools because of their support from groups that have not been traditional allies of public schools.

"So far, at least in my part of Mississippi, the people pushing for charter schools are former private-school administrators or parents," Mayo said. "I don't want a charter school that's been chartered by that group. That should be in the hands of the Department of Education."

Mayo also wants state law to restrict charter schools to districts that have been designated as failing or in danger of failing for two years in a row, keeping charters out of places like Madison or Desoto counties with already vigorous school systems. In struggling districts, Mayo argues, local control of schools is not working, and an outside organizationvetted and authorized by the state Department of Educationcould prove more effective.

State Superintendent of Education Tom Burnham has floated a similar proposal that would give the state Department of Education authority to consolidate districts when they fall under its control for poor performance. He has also suggested that MDE be allowed to open charter schools in those state-controlled districts.

Legislators have an added incentive to pass some form of a charter-school law this year, as it could help Mississippi's chances of acquiring up to $175 million in federal education funds. MDE is planning to apply in June for the U.S. Department of Education's Race to the Top program, which rewards states for enacting public education reforms like aligning tests to national standards and paying teachers based on student performance. Race to the Top is a competitive program, and states without a charter-school law are far less likely to receive funds. Mississippi's old charter law, which limited the state to a total of four charters schools, expired in 2009.

Reps. Alyce Clark, D-Jackson, and Reecy Dickson, D-Macon, are renewing their effort to make sex education more available in public schools, citing the prevalent ignorance of the issue as one of the reasons for the state's high teen-pregnancy rate.

The two are putting together a bill with Mayo to require every school district to adopt a sex-education policy. State law does not currently mandate that districts provide sex education. Even the heavily populated Jackson Public Schools district does not show any strong interest in the abstinence-only sex education officially recognized by the state.

The bill would phase sex education into the elementary and high-school years, with elementary sex education centering more on social education and relationship issues. The bill does not envision the mechanics of actual sex being introduced until the high-school years.

Insurance Reform and ATVs

Some bills on this year's agenda have little to do with money, believe it or not. Sen. David Baria, D-Bay St. Louis, will renew his annual call for an insurance policy-holders' bill of rights.

"I've tried several times on the policy-holders' bill of rights. I've pressed on this anti-concurrent causation exclusion in policies, but I just can't get the insurance committee chairman to bring it up. But I'm going to try again," said Baria, who also wants to establish a program similar to Florida's My Safe Florida Home program. The Florida Legislature created the program in 2006 to help Floridians identify and make improvements to strengthen their homes against hurricanes through 400,000 free wind inspections and $35,000 in grant funds to eligible homeowners.

"We've got to go farther," said Baria, whose coastal home was destroyed by Hurricane Katrina in 2005. "There is a National Association of Insurance Commissioners' model code that has been adopted by 48 states. Mississippi and Alabama have refused to adopt it at this point, and I'm going to try to get us to become the 49th state to adopt it."

Baria is also working to strengthen the state's open meetings law by stiffening the penalties for illegally closing public meetings from $500 to $1,000, and make the penalties apply to the individual violator rather than the government body. Government bodies, such as councils and boards, often follow the suggestion of one or two people in illegally closing a meeting to the public.

Aiming the penalties at the individual petitioner will keep taxpayers from footing the bill when somebody decides to break the law.

"The penalty is a mere tap on the hand, not even a slap on the wrist. They didn't have any disincentive to violate the law. If it violates the Open Meetings Act, then there ought to be penalties commiserate with the law," Baria said. "Give folks who want to pursue their challenges on the legality of closing meetings the right to recover their attorney's fees."

As an example of the current open meetings law's relative weakness, Baria cited an August 2009 incident, in which two of the three state transportation commisssioners, Bill Minor (not the columnist) and Wayne Brown, met over dinner to discuss an interchange project with state transportation director Butch Brown. They did not invite the third transportation commissioner, Dick Hall, and Hall subsequently lodged a complaint with the state Ethics Commission, arguing that the meeting violated the state's open meetings law. The Ethics Commission agreed, but it declined to fine the violators $100 each, because that money would have come from the state Transportation Commission's budget and thus, from state taxpayers.

Rep. Brandon Jones, D-Pascagoula, likely will submit another bill this year to restrict the governor's power to suspend prisoners' incarceration. Last year, some senators made a run at trying to force the governor to let society know when he's going to arbitrarily release convicted murderers and stalkers from prison. Jones and other senators pounced on the issue after the Jackson Free Press reported in 2008 that Barbour had orchestrated the release of a string of prisoners convicted of killing wives and girlfriends. The issue came to a head when Barbour granted a 90-day furlough to Leslie Bowlin, who got a life sentence plus 25 years in 1991 for rape and kidnapping after beating a young woman in the head with a gun and dragging her off to the woods. Jones' bill survived the House without issue, while a similar bill came out of the Senate with few people standing against it. The bill died in conference, however.

Baria also will push for a tax credit for "green energy" renovations to homes and businesses.

"We're talking about solar, geothermal and wind technologies, and high-efficiency appliances," Baria said. "The wind and solar stuff is a pretty valuable tax credit. If you would put a $25,000 wind or solar plant on your house, then you'd get up to a $12,500 tax credit, which would reduce the price of your installation by about 50 percent. The idea is to make it more affordable for folks to buy into these kinds of systems, make their use more widespread and to promote it in that fashion, but also to create jobs."

Mississippi currently is one of the few states that do not offer a state incentive for investing in wind or solar technology for homes.

Mississippi is also one of the few states that do not make some forms of animal cruelty a felony. Sen. Gray Tollison, D-Oxford, will submit a bill trying to change that this year.

"There are heinous crimes, like that poor dog burned to death down in Natchez, and another case out in Brandon," said Tollison, who champions the idea under the belief that some of the more demonic forms of animal cruelty are only the first course in a lifetime of potential cruelty that could eventually expand to human victims.

"This is not only about animals," Tollison said. "We've seen that the people charged with doing some of the most heinous things to animals sometimes do it to people later. (Milwaukee serial killer) Jeffrey Dahmer was cutting the heads off dogs and putting them on sticks before he started killing people."

Tollison is also looking to submit legislation regulating the use of ATVs. His bill is timely. Winona Police are still investigating an ATV accident earlier in December that claimed the life of a 13-year-old boy in Montgomery County. Sam Myers died at UMC hospital Dec. 11 after he landed on his head when the four-wheeler he was riding flipped over.

Some legislators are looking to expand on Barbour's call to close Oakley training school. The governor suggested closing several state institutions and steering offending minors to local rehabilitation services. Tollison said Hinds and Rankin counties offer examples of well-made local rehabilitation services for minors.

"It costs about $70 million to operate Oakley down there, with an average of 130 kids," Tollison said. "Barbour's proposing closing that and using some of the money from that to expand our adolescent community programs, which I think is a good idea.

Similarly, Baria is considering legislation to release certain non-violent offenders into criminal rehabilitation centers.

"It costs more to keep them in prison than alternative rehabilitation," Baria said. " Judge Keith Starrett, (now on the federal bench) started the diversion system in the drug court system. At the cost of about $1,500 per year they can go through an assimilation program, which is much less than housing them at Parchman, which runs $18,000 per inmate, per year."

Additional reporting by Ward Schaefer

Previous Comments

- ID

- 155636

- Comment

Bryant told The Clarion-Ledger. "The worst thing we could do right now is increase taxes." "Car tags also could face a substantial increase next year." Excuse me, Stupid, Paying for car tags is paying a tax. You've already jacked mine to ridiculous levels. The tag on my 05 Chevy Cobalt this past year was $240.00. This is a car I bought NEW for $13,000. How the hell is that right?

- Author

- ForgottenWard6

- Date

- 2010-01-30T10:16:36-06:00

- ID

- 155648

- Comment

Where is the article about Holland's proposal to make OTC allergy/cold meds prescriptions only? I just sort of wanted to go off about it for a hot minute! :)

- Author

- Lori G

- Date

- 2010-02-01T10:10:53-06:00

- ID

- 155650

- Comment

And GOOD GOD, how long is it going to take for us to get a lottery? Are they really trying to sell this horsesh*t that poor people will use their funds to buy lottery tickets instead of necessary goods and services? What the HELLL is a CASINO? I can't even believe they are going to take that stance. And, close Oakley. They do nothing but park SOME juvenile offenders out there and the rest can be DHS kids without a current placement. CLOSE IT. Its ramapant with mismanagement and how many times has the facility been accused of abusing kids? Route those funds into community based programs designed to deal with high risk/violent/mentally ill kids. (Disclosure: I run a community based mental health program for Jackson's at risk kids) :)

- Author

- Lori G

- Date

- 2010-02-01T10:37:24-06:00